Introduction

Each month, the U.S. Bureau of Labor Statistics (BLS) releases US employment estimates that provide a comprehensive view of job changes across various sectors. The Current Employment Statistics (CES) program is a key indicator of the U.S. labor market’s health, offering detailed insights into industry sectors, hours worked, full-time versus part-time employment, and average wages. These data points are crucial for the Federal Reserve and businesses in making informed decisions and serve as a strong indicator of the overall strength of the U.S. economy.

Summary

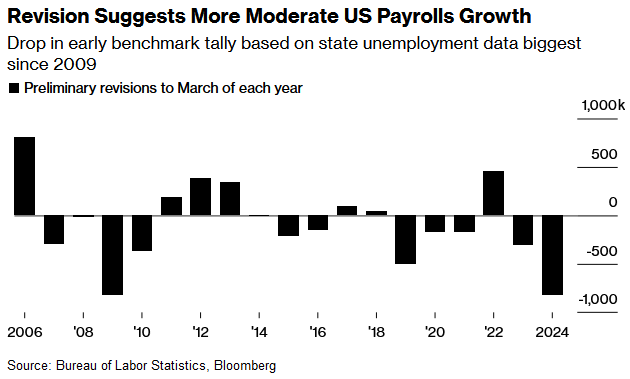

Yesterday, the BLS announced a significant downward revision to the total nonfarm employment figures for the period from April 2023 to March 2024, reducing the previously reported numbers by a staggering 818,000 jobs. This revision is nearly on par with the post-Great Financial Crisis revision in 2009, which saw a downward adjustment of 824,000 jobs—just 6,000 more than the current revision.

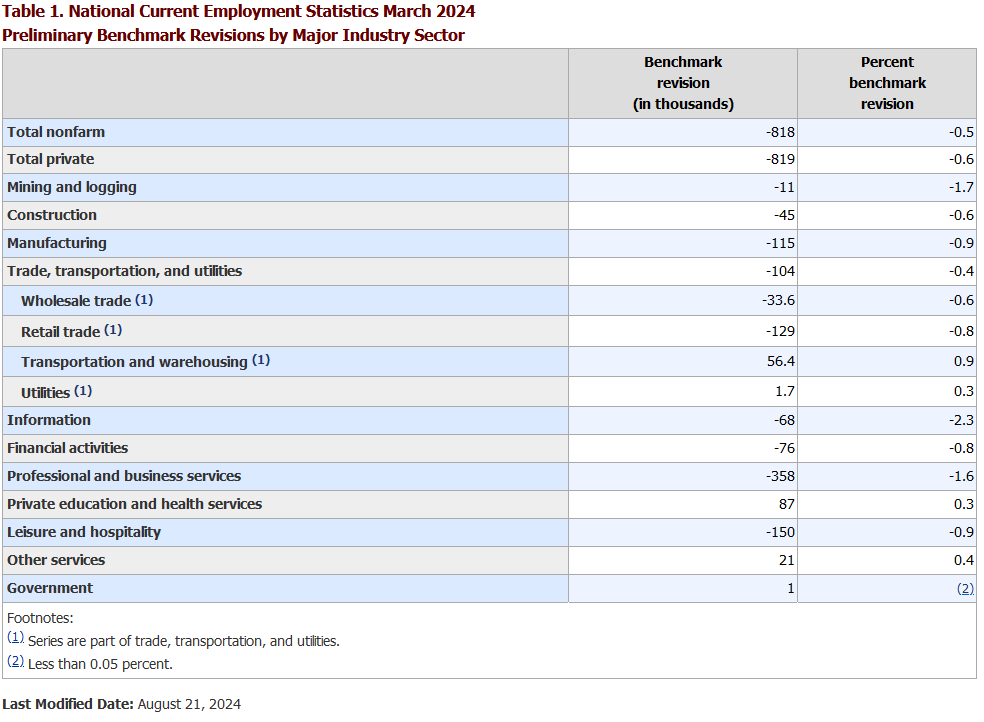

In the details, you can see large aberrations in the following industries:

- Construction -45,000

- Manufacturing -115,000

- Financial Activities -76,000

- Professional and Business Services -358,000

- Leisure and Hospitality -150,000

Implications for Investors

This significant revision suggests that the labor market was much weaker over the past year than initially reported. The most pronounced impact was seen in white-collar sectors, with Professional and Business Services alone being revised downward by 358,000 jobs.

This revision could prompt the Federal Reserve to consider easing monetary policy at a faster pace and with larger individual cuts. With inflation still hovering at 3%, the Fed faces a delicate balancing act: addressing economic and labor market weaknesses without triggering stagflation. Investors should be mindful of the potential for rate cuts and the broader implications for the economy as the Fed navigates this challenging environment.

Comments are closed