As NVIDIA, Apple, and Microsoft are the largest market caps while the YTD performance of Meta, Google, Amazon, and particularly NVIDIA lead the charge:

The numbers tell a sobering tale:

- Most of the P/E ratios of these tech giants dwarf the S&P 500 average of 28.33 trailing or 22.4 forward. Meta and Google are the only ones that don’t look incredibly expensive:

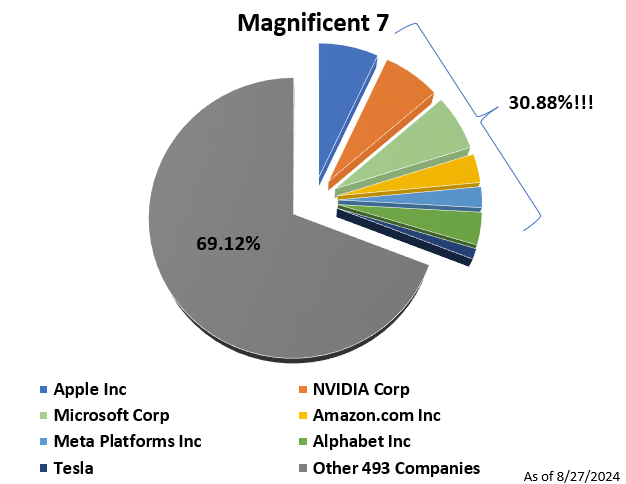

- Their combined market cap now represents an unprecedented slice of the S&P 500 pie with 7/500 or 1.4% of the companies representing 30.88% of the market capitalization!

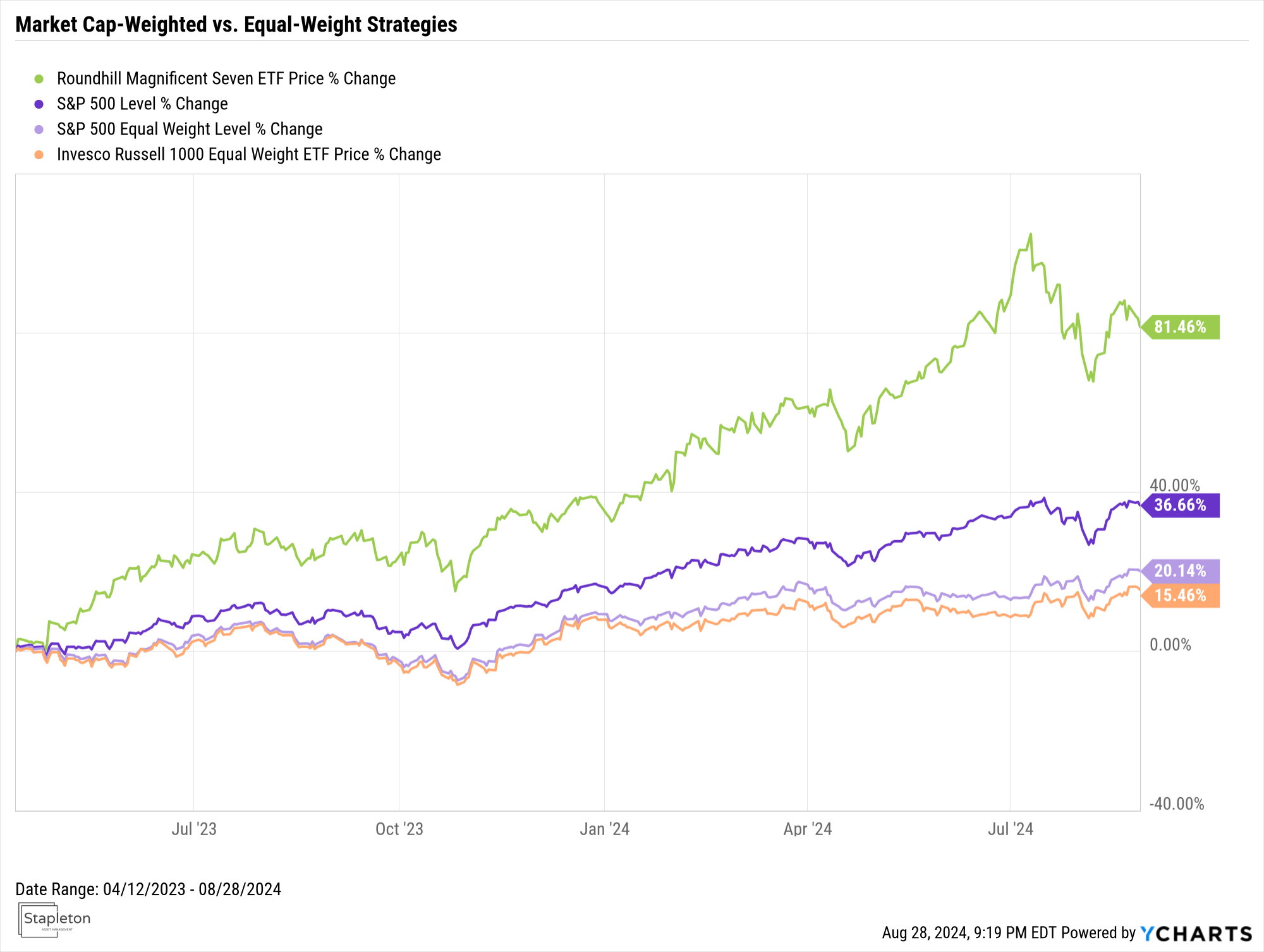

- Recent returns that make traditional investments blush. You can see that equal weighted indices have not done nearly as well as the S&P 500 by itself and the majority of that is driven by the Magnificent 7:

Sound familiar? It should. We’ve seen this movie before – think back to the late ’90s Nasdaq tech bubble and the dot-com frenzy that followed. History doesn’t repeat, but it often rhymes. And right now, it’s singing a tune that should make us all pause and reflect.

Are we witnessing innovation-driven growth with the break out of Artificial Intelligence (AI), or are we building castles in the sky?

The line between visionary investing and irrational exuberance is thin. As the Magnificent 7 stretch towards the stratosphere, it’s crucial to ask: How much higher can they go before gravity reasserts itself? Remember, what goes up must come down – unless it’s achieved escape velocity. The question is, have these tech titans truly broken free from economic realities and is this time really different?

What’s your take on the Magnificent 7’s meteoric rise? Is there a lot more runway or will the capital expenditures and the profitability of AI not live up to expectations?

Share your thoughts below, and let’s navigate these turbulent markets together.

#InvestingInsights #MagnificentSeven #MarketBubble #TechStocks

Comments are closed