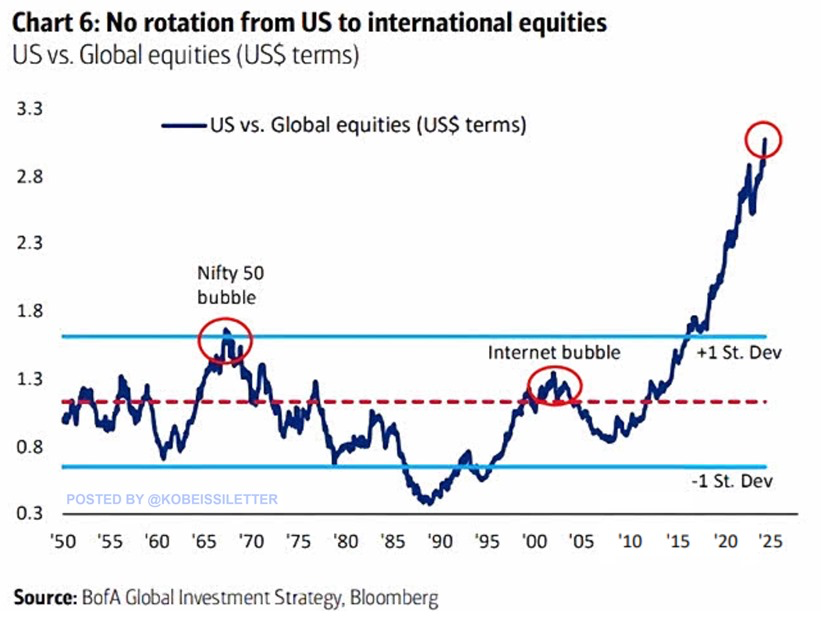

US stocks have reached a 75-year high in their relative valuation compared to the rest of the world, surpassing even the peaks seen during the infamous dot-com bubble and the Nifty Fifty era of the 1970s. Since the early 2000s, especially post-2008 financial crisis, US equities have consistently outperformed global markets, reaching levels not seen since the dot-com bubble at the turn of the millennium. This trend has only accelerated in recent years, with the US market trading at over 2 standard deviations above its long-term mean relative to global equities. What is driving this difference and is it sustainable?

Just How High are US Equity Valuations?

There are a few market valuation metrics that I find useful for broader market valuation.

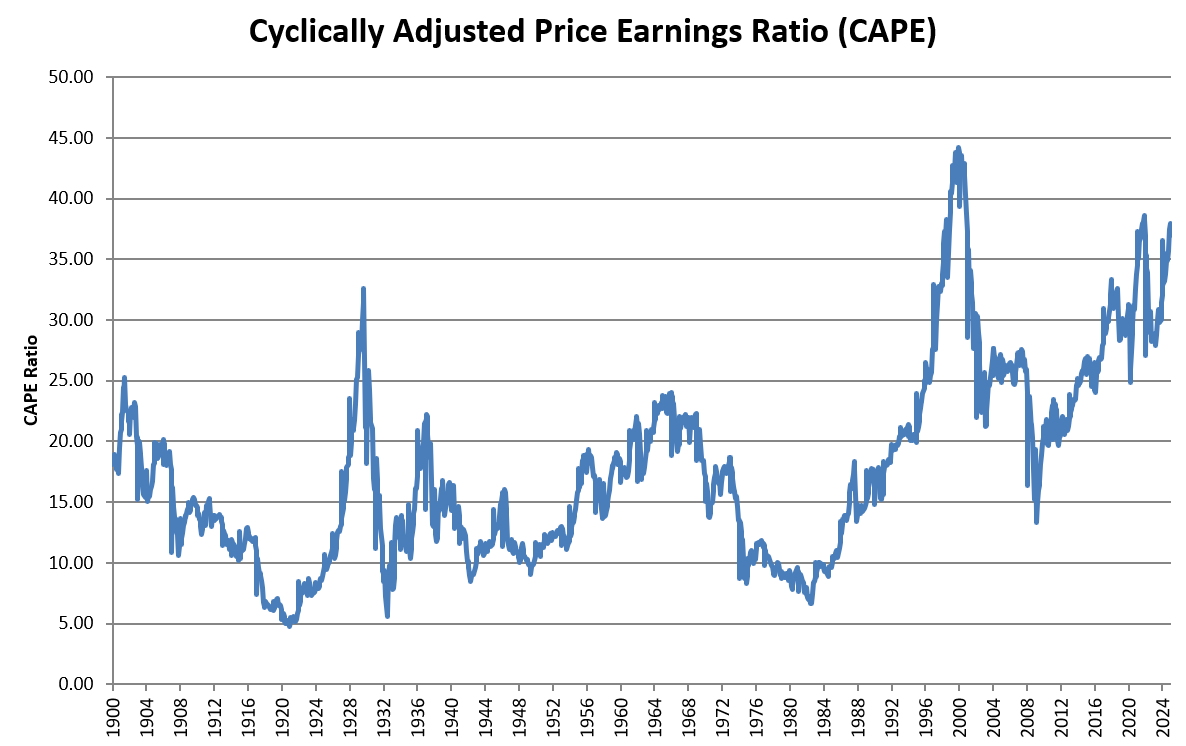

The first is the CAPE (cyclically adjusted price-to-earnings) Shiller ratio for the S&P 500. It represents the current S&P 500 Index Price / 10-Year Average Inflation-Adjusted Earnings. Think of it as a cyclically smoothed out Price/Earnings Ratio. In the early 20th century, the lower CAPE values show a ratio fluctuating around the historical average of 15-16 with the Great Depression falling below 5. Recent years show the CAPE ratio climbing well above 35, which is higher than most historical periods except for the tech bubble:

Is the increase in average CAPE just due to the accounting addition of Goodwill to the balance sheet?

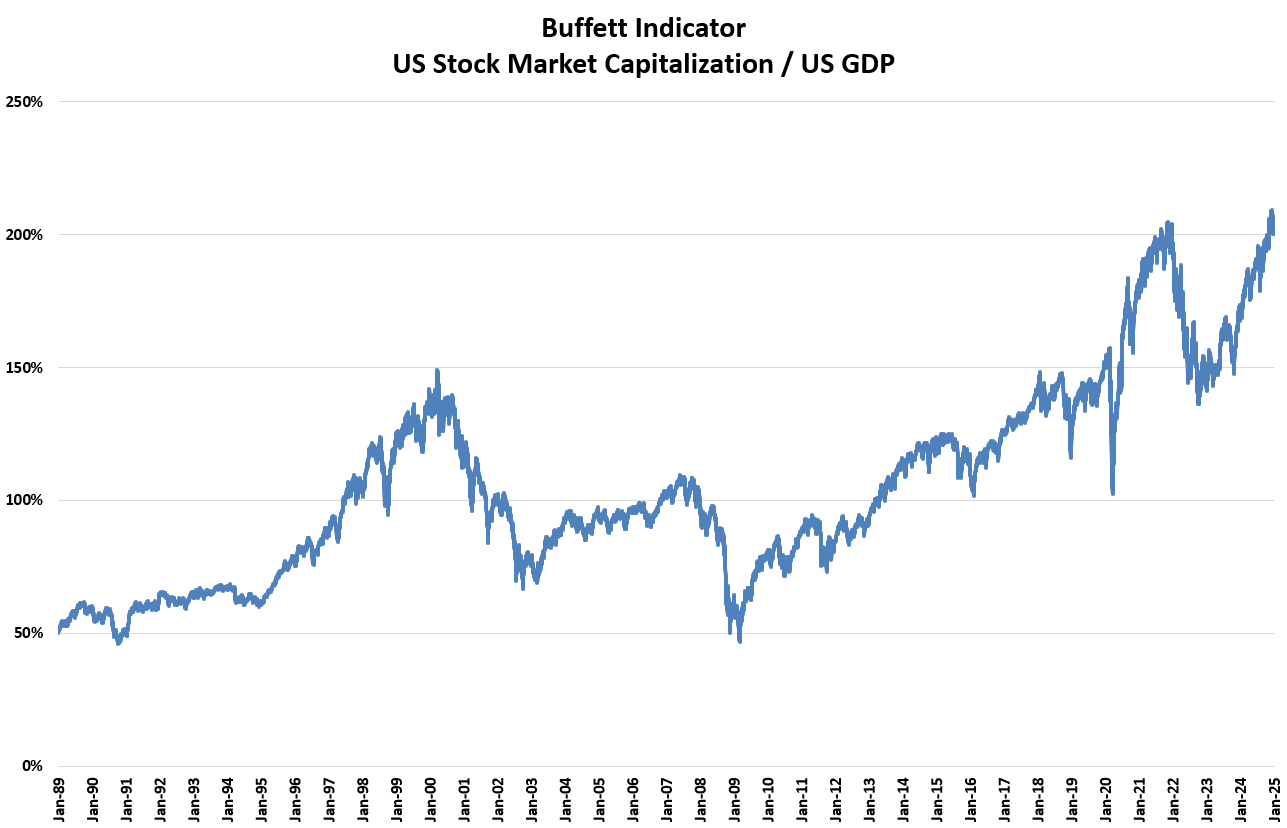

The second is the “Buffet Indicator” which is the ratio of the total market capitalization of the US stock market to the US GDP:

The Buffett Indicator has steadily increased over the past several decades, reflecting a growing gap between the stock market’s size and the real economy. This growth is particularly pronounced from the 1990s onward. In the last decade, the Buffett Indicator has surged well beyond the theoretical and historical fair value of 100%s. This divergence suggests that U.S. equity valuations are historically high (nosebleed) relative to the underlying economy.

Lastly is a stark comparison between the United States and the rest of the world. According to Bank of America, the United States valuation is 3x the rest of the world. At what point does this premium burst:

Trying to Rationalize High US Valuations

Despite the historically high (nosebleed) valuations, there are several rationales that we can lean on as to why US equity valuations might still be justified:

- Innovation and Technology: The US is home to many of the world’s leading technology companies, which have driven significant economic growth and market performance. Companies like NVIDIA, Apple, Microsoft, and Amazon have not only dominated their sectors but have also expanded into new areas, justifying high valuations due to their future growth prospects.

- Economic Stability: The US economy has shown remarkable resilience, especially in navigating through global economic downturns. This stability, coupled with strong corporate earnings, supports higher valuations as investors are willing to pay a premium for reliability.

- Liquidity and Market Depth: The US market is one of the most liquid and deepest in the world, attracting global capital. This liquidity can drive prices higher as more investors participate, including foreign investors seeking safety in US assets.

- Monetary Policy: The Federal Reserve’s policies have historically supported asset prices. Low interest rates for an extended period have made equities more attractive than bonds, pushing up valuations.

- Global Influence: The US dollar’s status as the world’s reserve currency and the global influence of US companies in international trade and politics underpin the high valuations by adding a layer of geopolitical stability and influence.

The Elephant in the Room

Despite these possible valuation justifications, the high relative valuation of U.S. stocks poses strong tail risks:

- Reversion to the Mean: Historical cycles suggest that extreme valuation gaps eventually normalize, either through a correction in U.S. equities or outperformance of global markets.

- Economic Slowdown: If the U.S. economy falters, high valuations could quickly become unsustainable.

- Inflation and Debt: The Federal Reserve is between a rock and a hard place as I have said before. If inflation is persistent they might have to raise rates to keep longer term interest rates in check and keep confidence in the dollar regardless of economic fallout.

Relatively Attractive Global Markets

Given this disparity, it seems that we should be searching for markets that are relatively undervalued. Here are a few markets that currently offer attractive valuations:

- Emerging Markets (EM): Countries like India, Brazil, and parts of Southeast Asia have shown significant growth potential but with valuations that are more reasonable compared to the US.

- Europe: European equities, particularly in sectors like manufacturing and finance, have not seen the same valuation inflation as US tech stocks.

- Japan: With its unique economic policies like Abenomics, Japan has shown resilience. Japanese stocks might not have the high valuations of US tech giants, presenting a case for value investment.

I will open up a deeper dive in a later conversation, but it is worth opening your mind to global opportunities. When the Wall Street Journal suggests, “A Quarter of Your Retirement Fund Just Isn’t Keeping Up” when referring to International Equities, it is probably time to dig into that opportunity.

Conclusion

While U.S. equities have outperformed global markets for years, massive valuation dislocations suggest it’s an opportune time to take some chips off the table and/or reallocate to more attractive markets. Emerging markets, Europe, and Japan offer more attractive opportunities that can provide diversification and potential upside.

Comments are closed