Federal Reserve

As the Federal Open Market Committee (FOMC) prepares for its July 29-30, 2025 meeting, we are all closely watching for any signals on interest rate policy. The current federal funds target range stands at 4.25% to 4.50%, with the effective rate hovering around 4.33%. The FOMC’s July session is widely anticipated to result in no change to the current rate range, with market consensus pointing to a 96.9% probability of holding steady. According to the CME FedWatch Tool, there’s only a slim 3.1% chance of a 25-basis-point (0.25%) cut, reflecting caution from the Federal Reserve as it assesses incoming data on inflation and employment.

This cautious stance has been rationalized by the FOMC due to concerns about inflation from the impact of tariffs on prices. So far, that fear has not materialized and we will see if the additional tariffs starting on August 1 will spark the inflationary wave that they fear. One of the indicators that the Fed has previously said is a major input into their decision-making process is the 5 year breakeven in five years. Put simply, it’s the expected 5-year inflation rate five years from today:

Figure 1-Despite new tariffs, the 5 year breakeven inflation in 5 years has been relatively stable between 2%-2.5%

We have also witnessed a consumer price index (CPI) that has been relatively calm and stable, much below the turbulence that we witnessed post COVID in the 2021-2024 time period:

Figure 2 – Total inflation, including food and energy, has been in the 3-4% range since Trump took office

Despite the fact that it is unlikely that the Fed will cut rates this week, it is worthwhile to estimate the impact of rate cuts and their financial impact on the Federal Government and individuals in the United States. When the Fed does decide to lower rates, adjustments are typically measured to avoid disrupting markets or reigniting inflation. President Trump has been vocal about his support for a rate cut and often cites 1% cuts as the example, but it is unlikely that we see a 1% cut in 2025 and it would normally take ~4 meetings if they decide to aggressively cut rates in order to support the economy.

Impacts on Individuals:

The Federal Reserve controls short-term interest rates via the federal funds rate. This rate is the interest rate at which banks and credit unions lend reserve balances to each other overnight as uncollateralized loans. This rate will have a direct impact on the interest earned in savings accounts and how much individuals pay on floating rate or short-term loans. This has a very direct impact on the interest paid on credit card balances as their interest is usually lockstep with the federal funds rate (prime = federal funds rate + ~3%). As of Q1 2025, total U.S. credit card balances stood at approximately $1.18 trillion. With an average interest rate around 20-24%, Americans pay an estimated $236-283 billion in credit card interest annually, based on revolving balances. If the federal funds rate is cut by 50bps (0.5%), then we would expect that total interest paid by US citizens on outstanding balances would be reduced by $1.18 trillion * .005 = $5.9 billion per year. According to Marketwatch, 45.2% of U.S. families carry credit card balances. With 60.5 million households carrying a credit card balance, the average savings per year would be ~$100 per household.

Unlike the interest paid on credit cards, home mortgages are generally longer in term and are driven by longer duration interest rates. The old saying is that the Fed pushes on the front part of a string, but it’s not clear how much it will impact interest rates with longer durations. The most common 30-year mortgage is generally priced on top of the 10-year treasury rate. The current 30-year mortgage rate is 6.9%, so we will estimate the optimistic impact of a 50 bps decline in the 6.9% 30-year mortgage rate down to 6.4%. Single-family mortgage originations are projected to reach $1.94 trillion in 2025.

A 50-basis-point drop in mortgage rates could yield aggregate annual interest savings of about $9.7 billion on new originations, assuming the reduction applies across the total volume (calculated as $1.94 trillion × 0.005). With approximately 3.4 million single-family home purchases, this equates to a loan amount of ~$410,000. This 50 bps decline would be about $2,000 of savings per home purchased.

Impact to the U.S. Federal Government:

The U.S. faces a significant “maturity wall” in 2025, with approximately $9.2 trillion in Treasuries—about one-third of outstanding marketable debt—set to mature and require refinancing. This includes a large portion of short-term debt like T-bills, which roll over frequently. Net interest payments on the national debt are projected to exceed $1 trillion in fiscal year 2026 under current trajectories, up from $881 billion in 2024. This now exceeds the annual budget for the defense department:

If rates fall by 0.50% or more in 2025, this could shave billions off annual interest expenses, as new bonds are issued at lower yields. Specifically, if the $9.2 trillion is refinanced at an interest rate 50 basis points lower than expected (assuming an average expected rate around 3.35%), the annual savings could amount to approximately $46 billion ($9.2 trillion × 0.005).

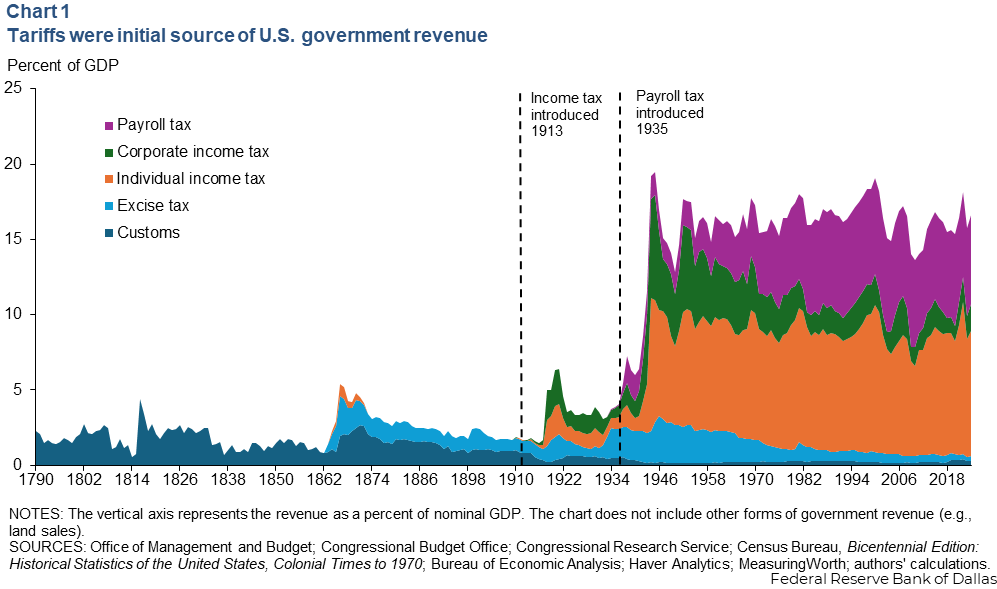

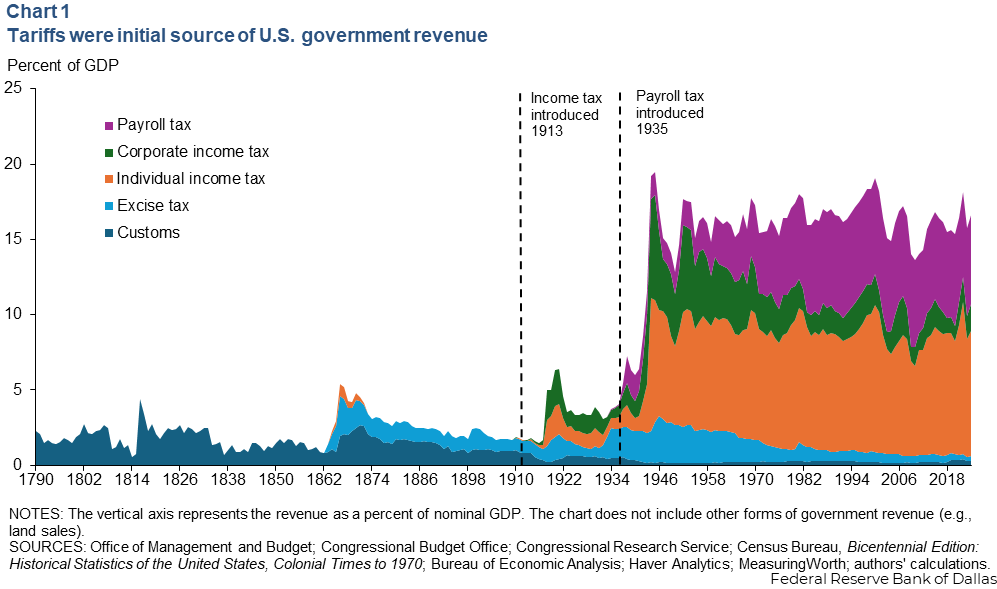

Tariffs and Taxes:

President Trump has also been vocal about getting rid of the federal individual income tax and replacing it with income from tariffs. The idea is appealing, but the math does not stack up. It is estimated that new tariffs will raise ~$300 billion per year, but Federal individual income tax was ~$2.43 trillion in 2024 which makes up about 50% of total Federal revenue. This means that projected income from tariffs could replace ~12% of current revenue from individual income taxes. Total imported goods are about $3 trillion in value, so a tariff rate would have to be over 80% in order to capture revenue that is similar in size to the individual income tax. The missing component in this equation is whether tariffs and open international venues for sale will create more corporate income tax as well as U.S. employment and rising wages.

Summary:

There are a lot of ways in which a lower federal reserve rate sparks investment and supports the economy, but I just wanted to put numbers into context. I have previously stated the fact that people are not great at understanding large numbers. There are a couple of quotes that address it:

“As the number of victims in a tragedy increases, our empathy, our willingness to help, reliably decreases. This happens even when the number of victims increases from one to two…. The feeling system doesn’t really add; it can’t multiply, it doesn’t handle numbers very well.”

– Paul Slovic (Psychologist)

“Our human brains are pretty bad at comprehending large numbers. Our brains are evolutionarily very old and we are pushing them to do things that we’ve only just recently conceptualized.”

–Elizabeth Toomarian

Understanding the scale and impact of these policy decisions is challenging, especially when dealing with these large numbers. A lower Federal Funds Reserve Rate will be beneficial to individuals and the Federal Government’s interest expense, as long as it does not help spark the invisible tax of inflation. The same goes for tariffs. If we can collect income from foreign nations and companies, it is beneficial, as long as it does not increase inflation. I have tried to make this analysis simple, but there are many moving pieces that can dramatically change the ultimate outcome. Will lower interest rates spark home ownership and the building of new homes? Will open international markets increase the sale of U.S. products? Will tariffs make U.S. products more attractive in the United States? Will lower interest rates foster more investment in the United States? The FOMC’s decision has a huge impact on our finances, but it would be much more impactful if congress could find ways to reduce the entitlement programs. Our budget can only be fixed by reducing expenditures. For fiscal year 2024 total federal government revenue was $4.4 trillion with $6.4 trillion of expenses. We cannot continue to run at a $2 trillion deficit without creating another financial crisis.

Disclaimer

This document and the information contained herein are provided solely for your information and Stapleton Asset Management marketing purposes. Nothing in this document constitutes investment research, investment advice, a sales prospectus, or an offer or solicitation to engage in any investment activities. This document is not a recommendation to buy or sell any security, investment instrument, or product, and does not recommend any specific investment program or service. Information contained in this document has not been tailored to the specific investment objectives, personal and financial circumstances, or particular needs of any individual client. Certain investments referred to in this document may not be suitable or appropriate for all investors. In addition, certain services and products referred to in the document may be subject to legal restrictions and/or license or permission requirements and cannot therefore be offered worldwide on an unrestricted basis. Although all information and opinions expressed in this document were obtained in good faith from sources believed to be reliable, no representation or warranty, express or implied, is made as to the document’s accuracy, sufficiency, completeness or reliability.

Comments are closed