Introduction

Over a year ago, we explained how the Japanese Yen Carry Trade works, and now we need to examine its implications as Japan has experienced significant market dislocation. After more than 25 years of ultra-low (and at times negative) interest rates in Japan, the Bank of Japan (BOJ) has finally begun a genuine normalization cycle. The BOJ raised its policy rate to 0.50% in January 2025, the highest level since 2008, and has made clear that further hikes are coming, with a 25 basis point increase to 0.75% expected at the December 2025 meeting as inflation remains above target and wage growth continues at the fastest pace in three decades.

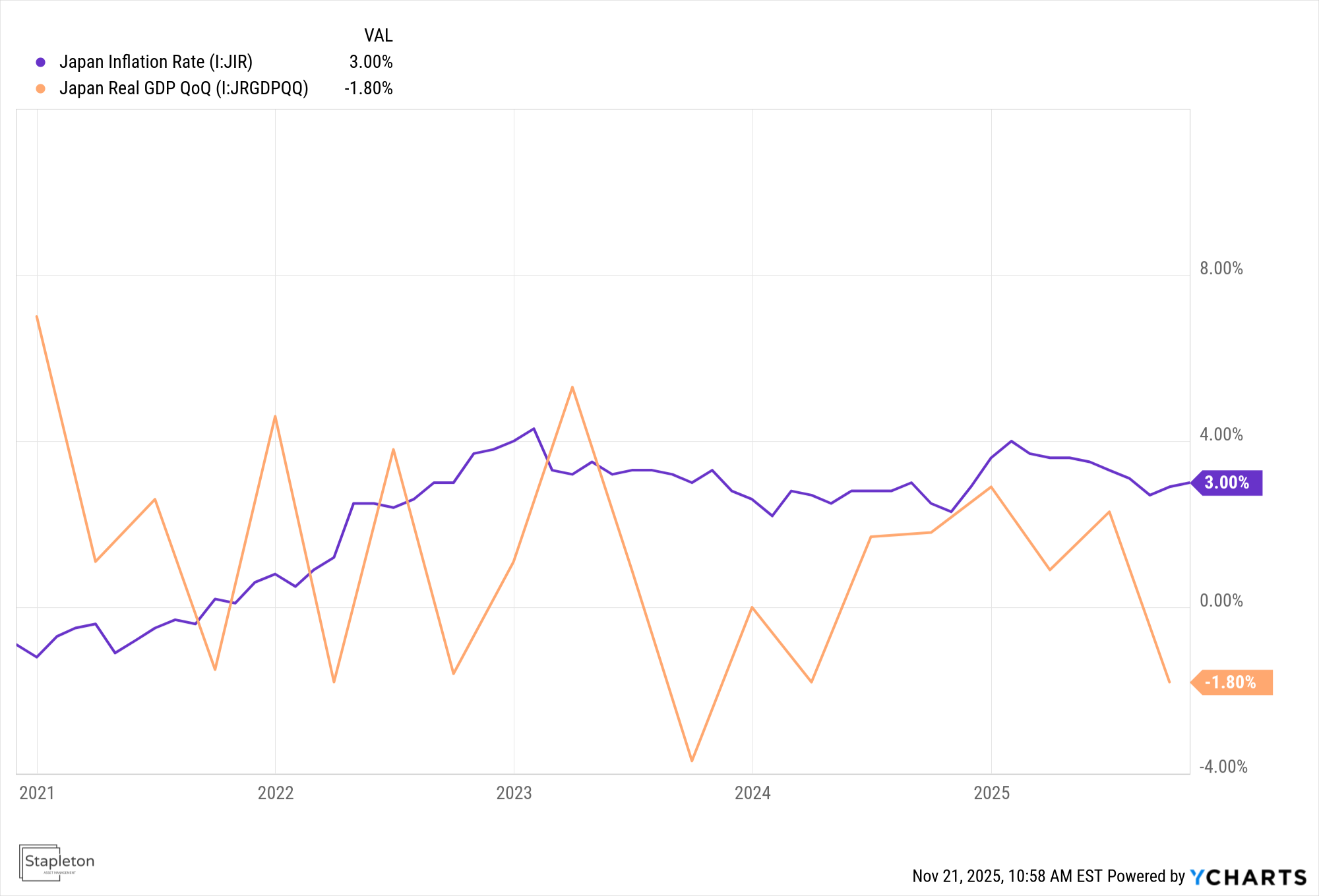

Japan’s core inflation rate rose to 3% in October 2025, marking the sharpest increase in three months and staying above the BOJ’s 2% target for the 43rd consecutive month. Meanwhile, nominal hourly wages rose 3.5% year over year in April 2025, indicating robust labor market momentum.

Figure 1 – Consistent 3%+ inflation above the target rate of 2% while the Annualized GDP crumbled -1.8%. Stagflation?

The progress in wage growth is under threat from a sharp economic downturn. Real GDP contracted by 1.8% annualized in the third quarter of 2025, the first decline in six quarters and the steepest in over a year, driven by weakening exports amid escalating U.S. tariffs and a plunge in residential investment. In response, pro-stimulus Prime Minister Sanae Takaichi (“Abe 2.0”) is set to unveil Japan’s largest economic package since the pandemic era on Friday, November 21, with ¥17.7 trillion ($112 billion) in spending funded by an extra stimulus budget. This expansive fiscal push is aimed at mitigating inflation’s impact on households and bolstering strategic sectors, defense, and foreign policy. It risks overheating an already strained economy and exacerbating Japan’s debt burden, which the IMF projects at 230% of GDP.

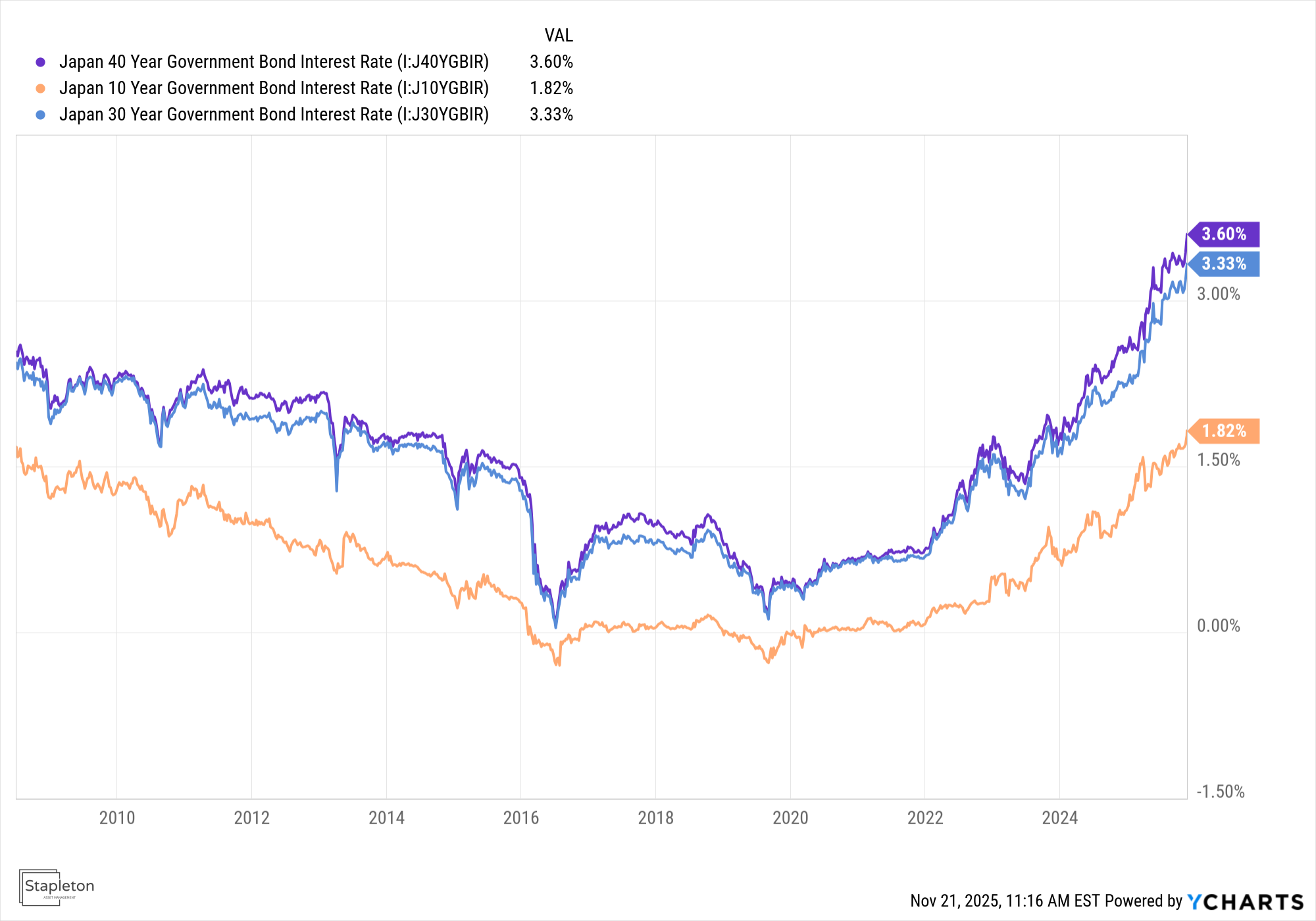

At the same time, the Japanese Yen has weakened dramatically amid the stimulus anticipation, a reversal of earlier appreciation that has reignited carry trade dynamics even as funding costs rise. Adding to this, Japanese Government Bond (JGB) yields have soared to record highs, with 10-year yields at 1.82%, 30-year yields at 3.33%, and 40-year yields at 3.6%. This signals bond vigilantes’ alarm over ballooning issuance and fiscal risks. As Deutsche Bank strategist George Saravelos warns in a recent note titled “A Bit Worrying,” the simultaneous collapse in the yen and long-end JGBs have decoupled from global fixed income rallies. This threatens broader capital flight, a loss of faith in low-inflation commitments, and potential spillovers to equities and non-fiat assets like Bitcoin.

Mechanics of the Reverse (Unwind) Carry Trade

For decades, investors and institutions borrowed in low-yielding yen, sold the yen, and reinvested the proceeds into higher-yielding assets globally: U.S. Treasuries, U.S. tech stocks, emerging-market bonds, Australian dollars, Bitcoin, and private equity. Borrow in Yen and invest in virtually anything that offers positive carry and currency upside.

The trade worked beautifully as long as:

- Japanese rates remained near zero

- The yen stayed weak or continued depreciating

Both assumptions have fractured under the weight of policy shifts and market reactions. Rising BOJ rates increase funding costs for yen borrowings, while the yen’s recent weakening provides temporary relief but masks underlying volatility from stimulus expectations. With soaring JGB yields, the “double whammy” persists: higher interest expenses plus currency swings erode positive carry, triggering margin calls and forced unwinds in non-Japanese investments.

The result is mechanical liquidation:

→ Sell foreign assets (U.S. Treasuries, Nasdaq stocks, etc.) → Convert proceeds back into yen → Repay loans to halt losses

This forced deleveraging, now intertwined with Takaichi’s stimulus endgame, risks a Minsky Moment for Japan, in which each round of larger spending offsets prior inflationary effects until systemic collapse looms.

Scale of the Trade and Potential Size of the Outflow

Estimates of the yen carry trade’s notional size exceed $1.5–2.0 trillion at its 2024 peak, with Japanese cross-border lending and derivatives as key measures. Major exposures include:

- U.S. Treasuries: ~$1.15 trillion in Japanese holdings, vulnerable to repatriation as JGB yields spike.

- U.S. equities, especially mega-cap tech: Leveraged bets on the “Magnificent 7” and Nasdaq.

- Global risk assets: EM debt, crypto, private credit.

A 20–30% unwind implies $300–600 billion in global selling pressure, heavily weighted toward U.S. markets. Takaichi’s ¥17.7 trillion stimulus package, requiring additional bond issuance beyond last year’s ¥6.69 trillion, could accelerate this by eroding confidence in Japan’s fiscal stability, prompting further capital flight.

Timing Considerations

The unwind accelerates into year-end:

- USD/JPY a break below 155 could trigger acceleration.

- Japanese fiscal year-end (March 2026) looms, pressuring repatriation; BOJ’s December hike to 0.75% could follow if inflation holds at 3%.

Peak selling is likely to span November 2025 to February 2026, with the stimulus rollout and auction outcomes as catalysts.

Conclusion

Japan’s yen carry trade fueled global leverage for decades. Its disorderly unwind, driven by BOJ hikes, Takaichi’s fiscal blitz, and bond/yen freefall, creates a massive macro shift, potentially the endgame for the “experiment” economy amid demographics and debt. Japan has always been the “canary in the coal mine” among developed countries with massive government debt and weak demographics. We are likely seeing their global market impact in Bitcoin, with the instant sell-off from a high of $126,198 in October to $82,866 today (-34%). This is probably also supporting the weakness we have seen in tech stocks despite Nvidia’s strong earnings.

Investors can navigate this by hedging risks and eyeing capitulation buys as liquidation persists. Contact us if you want to know how to protect your portfolio.

Comments are closed