As we are just 5 days away from the next presidential election, one trend appears certain regardless of the outcome: government spending will continue to rise. Whether Donald Trump or Kamala Harris takes office, both candidates’ policy agendas entail extensive fiscal expenditures. This spending trajectory suggests that inflation is likely to remain elevated and above the 2% target that the Federal Reserve has established, and may lead to persistently higher interest rates than market participants anticipated just a month ago.

Fiscal Dominance: A Common Ground for Both Candidates

Fiscal dominance is a situation in which the government’s spending, borrowing, and tax policies all overshadow the Federal Reserve’s monetary policy. The Fed tries to make everything work, but they are caught between a rock and a hard place. The Fed cannot control fiscal policies, but they try to keep the economy running smoothly without letting inflation get too hot. When the Fed sees slowdowns in the economy, they look to cut interest rates. When inflation is running too hot, or there are too many potential “bubbles” in the financial markets, they look to cool it down by raising interest rates. If the fiscal policy continues to spend money that it doesn’t have (print money), then it creates a persistent upward pressure on the level of inflation regardless of how well the economy is doing.

Inflation can be a complex concept for many people, but I always encourage those interested to explore Milton Friedman on how inflation is created. That video also shows Friedman slamming the politicians for pandering to voters as well as the citizens asking for more. Inflation is the most regressive tax there is, which makes it ironic because many of the fiscal policies that try to support lower income families potentially hurt them more.

Two Candidates with Loose Purse Strings

- Kamala Harris’s Spending Plans

Vice President Kamala Harris’ administration is expected to continue the Biden administration’s focus on social spending and green energy.

- Social program expansion to support families and reduce income inequality

- Climate initiatives aimed at combating climate change through green infrastructure

- Infrastructure modernization to improve national transportation and broadband networks

- Healthcare adjustments to improve accessibility and affordability

- Increased education funding for students and educators

- Donald Trump’s Spending Plans

If Donald Trump returns to office, his economic vision includes an aggressive focus on defense spending, infrastructure investments, and tax cuts. His “America First” agenda prioritizes manufacturing and infrastructure projects designed to reduce reliance on foreign economies, which would predominantly be achieved through tariffs and negotiation tactics with foreign rivals.

- Enhanced border security funding to strengthen national security

- Increased military spending to boost defense capabilities

- Infrastructure projects designed to revitalize American manufacturing

- Trade enforcement mechanisms, including tariffs on foreign competitors

- Tax cuts for individuals and corporations to stimulate economic activity

Market Expectations vs. Fiscal Realities

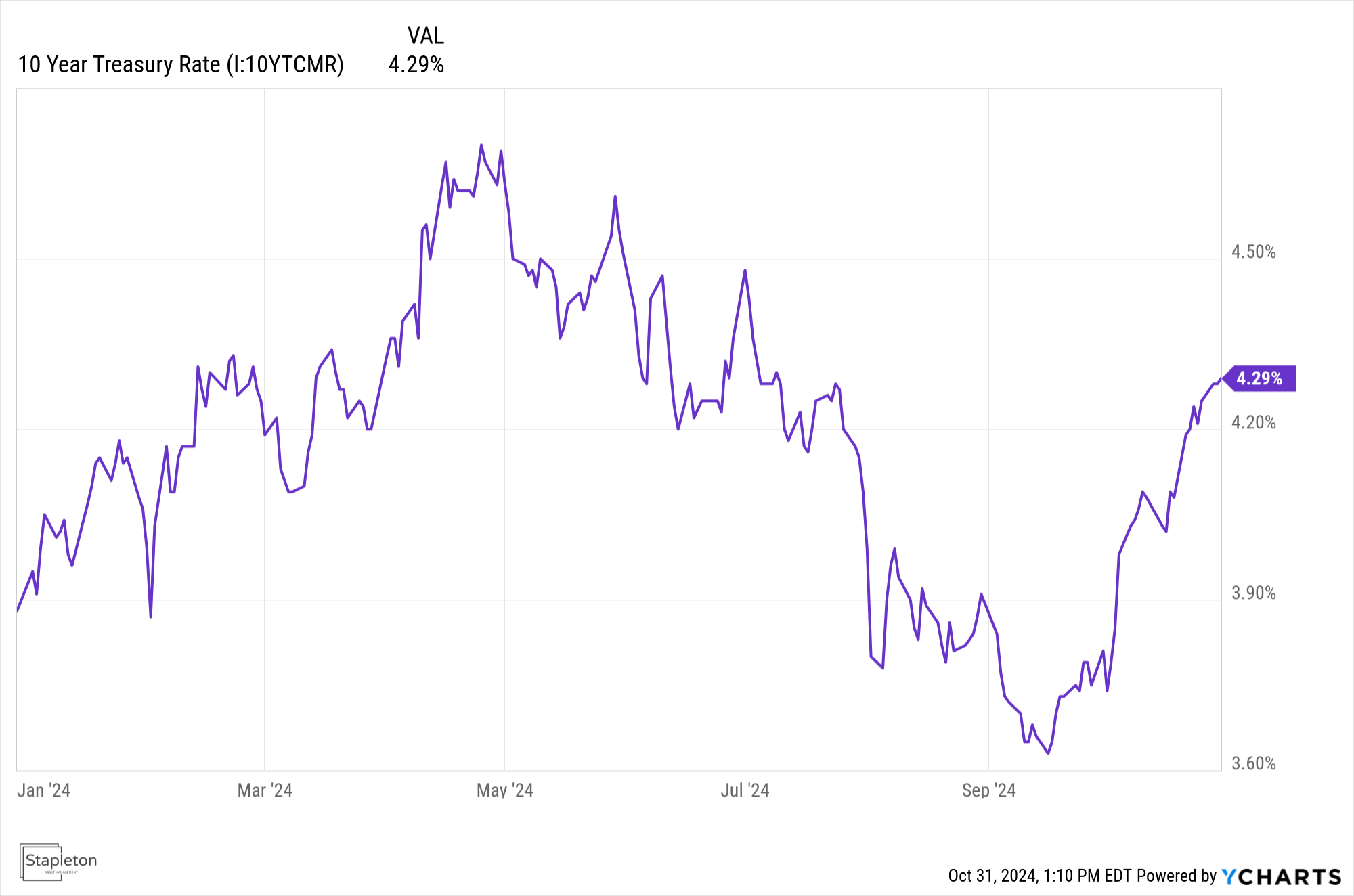

The Federal Reserve has set a long-term inflation target of around 2%, and the market has generally anticipated a gradual reversion to this level as pandemic-era disruptions subside. The recent reversal in the 10-year Treasury yield suggests otherwise:

Figure 1 The 10 Year Treasury Rate dropped from a high of 4.7% in May to a low of 3.6% in September. In a few short weeks we have retraced the majority of that due to increased concerns about inflation.

Rising Interest Rates

If we believe that average inflation will stay above 3% (which I do), the impact to the market over the next five to ten years will support higher levels of interest rates. It seemed way too early for the Fed to cut the federal funds rate considering most asset prices (stocks, real estate, etc) were at or near record highs. If the economy continues to grow, the lower Fed rate along with additional fiscal spending is bound to bring inflation back. To curb inflation, the Federal Reserve will likely raise interest rates gradually. If inflation spikes unexpectedly, then they will have to move the federal funds rate quickly to counteract. This scenario would impact borrowing costs for businesses and consumers, which implies that stocks would be hurt significantly by large inflationary surprises. This is not a forecast in the near-term, but a thesis that should be in the back of our minds as we invest in the coming quarters and years.

Conclusion

We can argue whether the increase in federal debt is $2 trillion or $10 trillion over the next 10 years due to policy changes, but we should really just be concerned that it is moving in the wrong direction. Most of the investment professionals that I have worked with are shocked that we have made it this far without larger market impacts. With politicians oblivious to the tail risk that they are taking, I believe that we broadly take it for granted that the US dollar still maintains its reserve currency status. It is unfortunate that I believe that politicians will only work to get their “house in order” when the market forces it.

It is unlikely that we would reach a hyperinflationary scenario such as what happened in the Weimar Republic, Zimbabwe, or Venezuela; but we should be cognizant that when you let the inflation genie out of the bottle it is hard to put it back in. I will leave the discussion about the US Dollar reserve currency status for another time, but we should all be prepared for the upside in inflation versus a reversion to what we feel is “normal”.

Comments are closed