In early 2025, the Department of Government Efficiency (DOGE), spearheaded by Elon Musk, has been touted as a potential game-changer for tackling wasteful federal spending. Most Americans support the idea of dramatically cutting the federal government’s size and scope, but the elephant in the room is not being addressed. DOGE’s reported estimated savings of $115 billion (NPV) so far pale in comparison to the scale of the U.S. fiscal challenge. With the national debt exceeding $36.6 trillion and annual interest expenses alone over $1 trillion, DOGE’s initial efforts are a step in the right direction but represent less than 1/3 of 1% of the current debt. We are talking about current debts, but the massive issue is the exponentially growing debt in the future. To actually balance the budget and stabilize the debt-to-GDP ratio at 100% for the foreseeable future, extraordinary measures are required.

DOGE’s Limited Scope in the Face of a Massive Debt

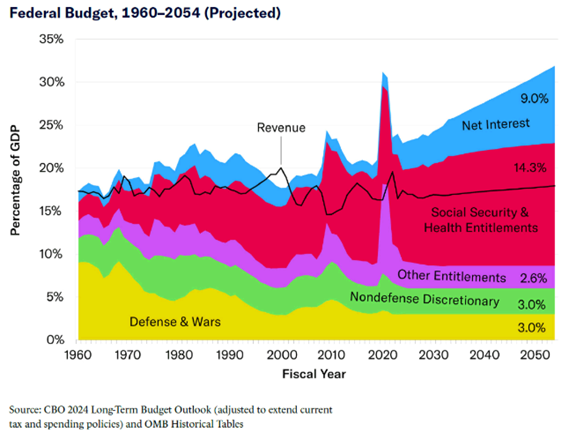

The U.S. federal budget is a behemoth, with annual spending projected to be over $6 trillion in 2025. Approximately 70% of this, or $4.2 trillion, goes toward mandatory programs like Social Security, Medicare, Medicaid, and defense. Given the hand-wringing that has occurred with DOGE’s efficiency efforts, its unimaginable what sort of miracle it will take to get massive transformation of politically entrenched entitlement programs. Interest on the national debt, over $1 trillion annually, is driven by rising debt levels and higher interest rates. Discretionary spending, where DOGE’s efforts are focused, accounts for less than 30% of the budget, or roughly $1.8 trillion, and much of this is tied to many essential functions.

DOGE’s efforts could achieve savings in the $100’s of billions per year, but it would still leave the vast majority of the deficit untouched. The math is pretty crystal clear: discretionary cuts alone cannot bridge the fiscal gap.

The Rising Debt Crisis

The U.S. debt-to-GDP ratio currently hovers around 100%, a level not seen since World War II. According to the Congressional Budget Office (CBO), it is projected to climb to 118% by 2035 and 166% by 2054 under current policies. Annual deficits are averaging 6–7% of GDP, which far exceed the historical norm of 2–3%. The interest cost alone likely will exceed defense spending in 2025.

DOGE’s mission to streamline government efficiency is laudable, but its focus on discretionary spending sidesteps the entitlement programs that are growing rapidly in the future. It is projected that Social Security, Healthcare and interest payments would consume 23.3% of US GDP by 2054 and total expenditures would be about 32% of GDP. This is without a rise in interest rates.

Figure 3 – Notice that Pre-2000, even during war-times, the total outlays were generally less than 20% of GDP

To stabilize the debt-to-GDP ratio at 100% over 30 years, experts estimate that annual net savings must reach 5% of GDP, roughly $1.5 trillion today, while growing with the economy.

Taxation Fallacies

There has been a push to increase taxes on high-income or wealthy individuals (tax the rich), but the United States is relatively in line globally for taxation on the wealthy. The top marginal tax rate is 37%, but when layering in state income tax like California, it can easily exceed 50%:

- France: Top marginal income tax rate is 45%, plus a solidarity surcharge that can push the effective rate above 50% for very high earners

- Germany: Top rate is 42%, or 45% with a solidarity surcharge (5.5% of tax liability), totaling around 5%

- UK: Top rate is 45% for income over £125,140, with National Insurance contributions dropping to 2% above a threshold, making the total burden around 47%

- Japan: Top rate is 45%, plus a 10% local tax, totaling 55%

- Canada: Federal top rate is 33%, but with provincial taxes (e.g., Ontario’s 13.16%), it can reach 46-54% depending on the province.

The U.S. corporate tax rate was reduced to 21% federal by the 2017 Tax Cuts and Jobs Act, with an average combined federal-state rate of 25.8% (Tax Policy Center, 2023). Comparing the 25.8% to other countries shows that it is in line:

- France: Statutory rate is 25%

- Germany: Combined rate (federal + local trade tax) averages 29-31%, depending on locality.

- UK: Rate increased to 25% in 2023

- Japan: Combined rate (national + local) is about 6%

- Canada: Federal rate is 15%, but with provincial taxes, the combined rate averages 26-27%

The act of increasing taxes on the rich and/or corporations would not make a dent in our budget problem and it would likely drive businesses and wealthy individuals out of the country, which would make our problem worse.

Draconian Measures to Close the Deficit and Stabilize Debt-to-GDP

Achieving fiscal balance requires a multi-pronged approach that goes beyond DOGE’s current scope. Below are key measures:

- Reform Social Security

- Raise Eligibility Ages: Gradually increase the early (62) and normal (67) retirement to 64 and 69, reflecting longer lifespans (Maybe not even true)

- Adjust Benefits: Shift initial benefit calculations to CPI growth versus wage growth. Means-testing for higher earners while protecting low-income retirees.

- Overhaul Medicare and Medicaid

- Increase Eligibility Age: Raise Medicare eligibility from 65 to 67, aligning it with Social Security.

- Reduce medical care costs and inefficiencies in the Medicare/Medicaid system

- Boost Revenue

- Implement a Value-Added Tax (VAT)

- Raise Taxes Modestly Across the Board (political hara-kiri)

- Remove Additional Deductions

- Invest in infrastructure programs to create jobs and stimulate the economy

The Path Forward

The U.S. faces a narrowing window to act. With 4 million baby boomers retiring annually, delay only deepens the fiscal hole. Stabilizing the debt-to-GDP ratio at 100% is achievable, but truly difficult to imagine given the disfunction of our two-party system. The alternative – inaction – risks a debt crisis that could destabilize the economy, create spiking inflation/interest rates, while causing concern about the US Dollar’s reserve currency status. I have said in the past; I don’t have a strong belief that politicians will react prudently with large needed changes until we hit that crisis point.

Comments are closed