Over-Valued Dollar

The recent excitement has been about pressure on the Federal Reserve to lower the Fed Fund’s rate. I addressed it primarily in “Interest Rates and Tariffs: Putting Numbers Into Perspective”. My conclusion was that it is an important tool amongst many, but not a one-stop solution. I addressed “Tariffs, Trade Deficits, and Government Debt” trying to distill how all of these pieces are interrelated. Now we should add a component that is the elephant in the room, the strength in the US Dollar

The core issue at hand is the persistent overvaluation of the U.S. dollar, which perpetuates trade deficits and undermines domestic manufacturing competitiveness. This overvaluation stems from the dollar’s status as the global reserve currency—a phenomenon known as the Triffin Dilemma. The Triffin Dilemma, named after economist Robert Triffin, refers to the conflict of interest faced by a country whose currency serves as the global reserve currency. It happens because the issuing country has to supply enough currency to meet global demand for trade and reserves, which generally requires running trade deficits. These persistent deficits erode confidence in the currency’s value, which can destabilize its status as a reserve currency.

As global economic growth outpaces that of the U.S., inelastic demand for dollar-denominated assets, such as Treasuries, sustains an elevated exchange rate. Consequently, U.S. exports become less competitive, while imports remain artificially affordable, exacerbating current account deficits. The US economy peaked as a percentage of global GDP at 40% in 1960. As of last year, it was approximately 27.49% of the world economy.

The relatively strong dollar poses a significant headwind to reshoring initiatives. If I had a nickel for every article that I have read that says we can never compete with foreign manufacturers because our workforce is too expensive and our end product is too expensive. A strong dollar increases production costs for U.S. firms relative to foreign competitors, deterring investment in domestic facilities despite incentives like tariffs or subsidies. History has proven this: manufacturing employment has declined from over 30% of total U.S. jobs in the 1950s to around 8% today, with the “China shock” alone displacing millions of jobs in the 2000s. Without currency adjustments, onshoring will be exceedingly difficult and risk failure, as elevated input costs and uncompetitive pricing hinder sustainable reshoring. Automation and AI can change the game, but I will leave that discussion for another day.

Policy Decisions

On August 7, 2025, President Trump nominated Stephen Miran, Chair of the Council of Economic Advisers and a key architect of the administration’s tariff strategies to fill a temporary vacancy on the Federal Reserve Board of Governors. The fixation of the media has been on his short-term position, until January 26th 2026, that grants Miran a vote that would help Trump achieve rate cuts. This fixation in isolation is silly in my mind. In November 2024, Miran wrote a very good research piece titled, “A User’s Guide to Restructuring the Global Trading System”. Worth a read (with a cup of coffee). This nomination goes beyond Fed rate setting and has a broader context around the integration of fiscal, trade, monetary, and every other lever available to address longstanding structural imbalances.

Looking ahead, these imbalances create future instability. Widening trade gaps will strain fiscal resources, heighten geopolitical vulnerabilities—particularly with China. Continuously rising government debt levels will eventually create a loss of faith in creditworthiness of the US Government. If/when that happens, you can think of rising rates, spiking inflation (stagflation), deeper economic recessions, and faster job losses. A death spiral of sorts.

The administration seeks to mitigate this by promoting burden-sharing among allies, linking trade policies with security commitments. Tools such as tariffs, which generated substantial revenue in 2018-2019 with minimal inflation due to currency offsets, offer a way to reallocate demand toward US producers. Proposed rates of up to 60% on China and 10% globally can increase Treasury revenues while pressuring partners to share more of some expenses, such as military defense.

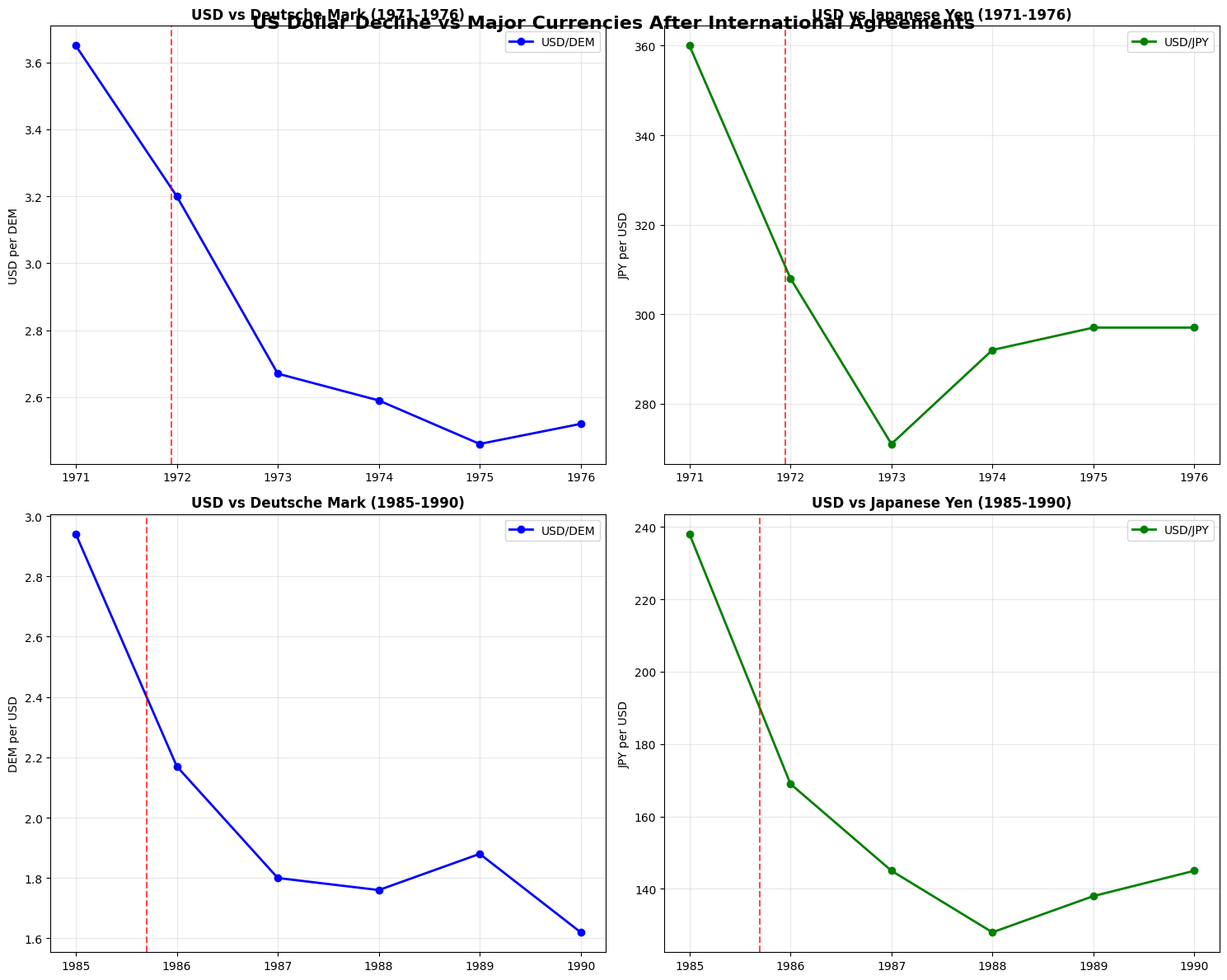

Currency interventions represent another lever through multilateral accords akin to the 1971 Smithsonian Agreement and the 1985 Plaza Agreement. Both of those agreements came to address US trade imbalances through proactive currency interventions. The Smithsonian came after the collapse of the Bretton Woods system and aimed to devalue the dollar by 8.5%, but ended up depreciating the dollar by 15-20% by 1976. The Plaza Agreement ended with a decline in the dollar by 50% vs the Japanese Yen by 1987.

A new international agreement could weaken the dollar, which would aid exporters, but require careful coordination with the Federal Reserve to avoid yield spikes or inflationary pressures. Miran’s Fed role may facilitate this type of alignment, which would use all of the tools available to minimize market volatility.

An intriguing market movement in this context is the substantial increase in gold imports into the United States in late 2024 and early 2025. There was a dramatic surge in imports, with monthly gold imports escalating from a $1-4 billion range to over $13 billion in December 2024, $20 billion in January 2025, and a record $36.2 billion import spike in February. This is about a 44% increase over the same period in 2024.

The imports appear to be driven primarily by private sector investors, including banks and traders. JP Morgan, the world’s largest bullion dealer, delivered $4 billion in gold bullion against expiring contracts in February 2025. It is thought that they were stockpiling gold in anticipation of tariffs, with significant inflows from countries like Switzerland, Canada, and others, as a safe-haven bet amid trade tensions. Was it just about tariffs, or are they forecasting another international agreement and currency intervention?

Global central banks have also been net buyers of gold—on track for over 1,000 metric tons in 2025—the U.S. Federal Reserve has not publicly increased its holdings, which remain at approximately 8,133 tons valued at a statutory $42.22 per ounce.

This gold accumulation raises questions about whether repricing US gold reserves could form part of the administration’s strategy to address trade imbalances and fiscal pressures. Speculation has grown around revaluing the Treasury’s gold holdings from the current book value of about $11 billion to market prices which would increase the holdings to ~$935 billion. This would generate a $924 billion in one-time gains that could fund initiatives like a sovereign wealth fund, Bitcoin reserve, or debt relief. This type of move has historical precedents, like the 1934 Gold Reserve Act, which revalued gold by 69% to bolster the economy. It could align with efforts to weaken the dollar for export competitiveness, as outlined in Miran’s framework, by signaling a shift away from pure fiat reliance.

Conclusion

Without going further down this rabbit hole, in order to try to balance the imbalances that currently exist, there is a strong incentive to devalue the dollar versus other major global currencies in order to successfully onshore certain manufacturing sectors (Semiconductors/Electronics, Pharma, Defense & Aerospace, Green Energy & Batteries, Rare Earth Metals, Robotics, etc.)

This is not an easy task. It is a balancing act at the highest order. Try to weaken the dollar, impose tariffs, reshore manufacturing, and get international agreement while trying to keep a cap on interest rates, inflation, and maintain the US Dollar’s status as the global reserve currency. We should also try to sidestep a deep recession…

I am not going to forecast what is going to happen and whether the measures will be successful, but this thought process rhymes with my overall sentiment that real assets and inflation protected securities are a key component in weathering what is coming next. I will spend the coming months researching the strategic asset allocation that best protects against these potential dislocations. Who knows, I might even start giving crypto a harder look…maybe…

Comments are closed